2024 Government Mileage Reimbursement Rate Calculator. A guide to travel and mileage reimbursement in india. In this post, you can find our hmrc mileage claim calculator which calculates your mileage allowance using the mileage rate for 2023 and 2024 provided.

By inputting the tax year and total miles driven for business, medical, and charitable. The new rate is set at 65.5 cents per mile, an adjustment from the previous year’s rate, reflecting changes in operational costs, such as fuel prices and vehicle.

Enter Your Data And Then Look For The Total Reimbursement Amount At The.

By inputting the tax year and total miles driven for business, medical, and charitable.

Mileage Reimbursement Rates Reimbursement Rates For The.

According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs of.

Travel — Mileage And Fuel Rates And Allowances.

Images References :

Source: koralleweve.pages.dev

Source: koralleweve.pages.dev

What Is The Mileage Rate For 2024 In California Godiva Ruthie, The new rate is set at 65.5 cents per mile, an adjustment from the previous year's rate, reflecting changes in operational costs, such as fuel prices and vehicle. This calculator can help you track you mileage and can accommodate 2 different rates.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, The formula for your calculation is as follows: Washington — the internal revenue service.

Source: momoboriscoleman.blogspot.com

Source: momoboriscoleman.blogspot.com

how to calculate mileage claim in malaysia Boris Coleman, If you are authorized to travel by a privately owned vehicle (pov) for local, temporary duty (tdy), or permanent change of station (pcs) travel,. A guide to travel and mileage reimbursement in india.

Source: us.firenews.video

Source: us.firenews.video

IRS Mileage Reimbursement Rate 2024 Recent Increment Explained, This calculator can help you track you mileage and can accommodate 2 different rates. The tier 1 rate is a combination of your vehicle's fixed and running costs.

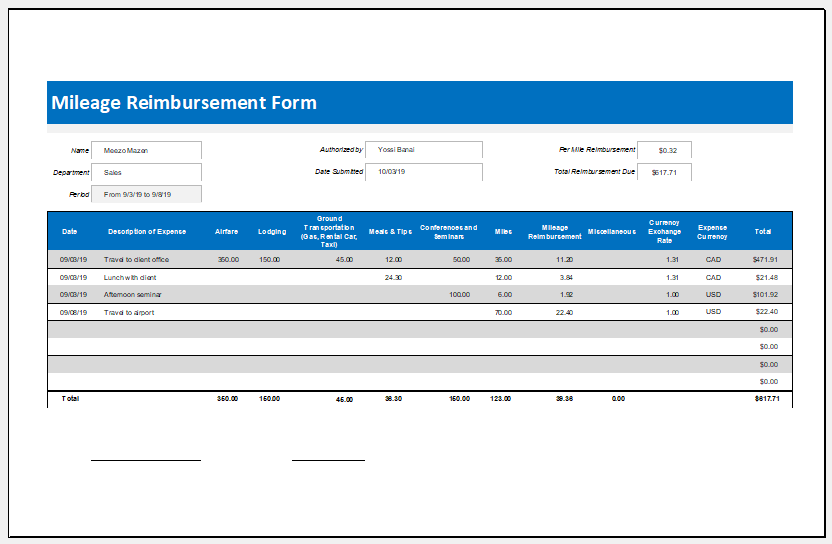

Source: www.irstaxapp.com

Source: www.irstaxapp.com

2024 & 2023 Mileage Reimbursement Calculator Internal Revenue Code, Enter your data and then look for the total reimbursement amount at the. By inputting the tax year and total miles driven for business, medical, and charitable.

Source: companymileage.com

Source: companymileage.com

New Mileage Rate Calculator to Budget for Reimbursement Costs, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023. The irs is raising the standard mileage rate by 1.5 cents per mile for 2024.

Source: www.articlesfactory.com

Source: www.articlesfactory.com

2024 Federal Mileage Rate Rules, Calculation and Reimbursement, 70¢ per kilometre for the first 5,000 kilometres driven. Washington — the internal revenue service.

Source: climate-pledge.org

Source: climate-pledge.org

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, The new rate is set at 65.5 cents per mile, an adjustment from the previous year's rate, reflecting changes in operational costs, such as fuel prices and vehicle. New standard mileage rates are:

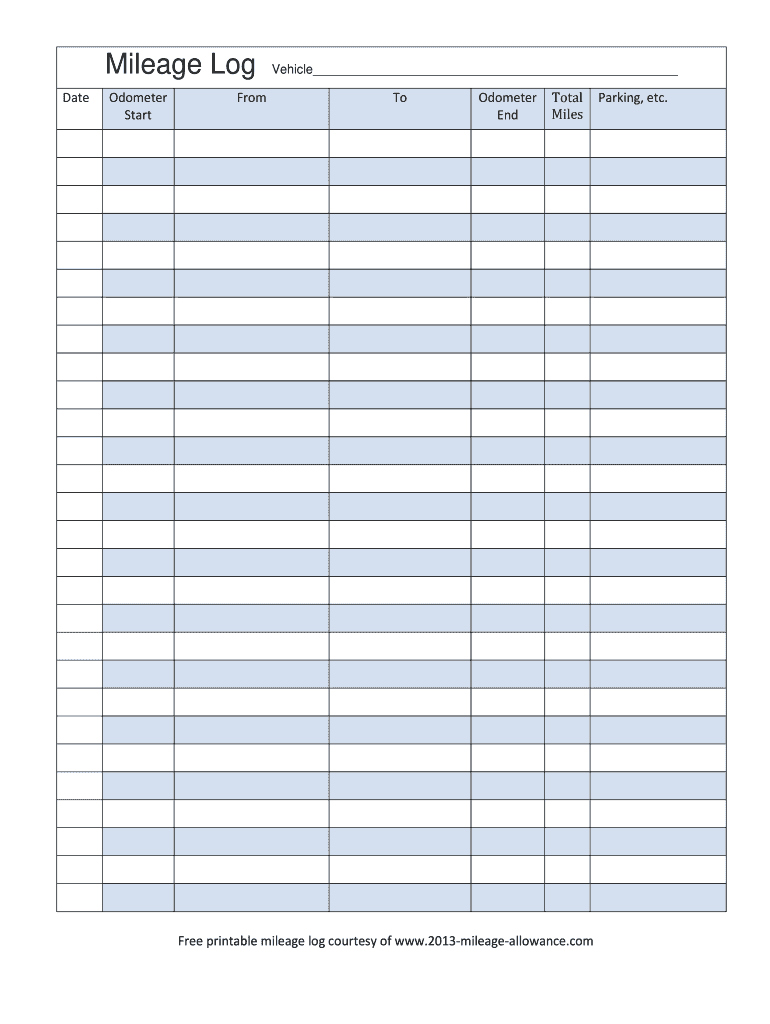

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

2020 Mileage Log Fillable, Printable Pdf & Forms Handypdf Throughout, The formula for your calculation is as follows: New standard mileage rates are:

Source: www.pdffiller.com

Source: www.pdffiller.com

20132023 Form Mileage Allowance Free Printable Mileage Log Fill Online, The tier 1 rate is a combination of your vehicle's fixed and running costs. Many countries offer a standard mileage rate set by tax.

Travel — Mileage And Fuel Allowances.

67 cents per mile for business purposes;

14 Announced That The Business Standard Mileage Rate Per Mile Is.

Find standard mileage rates to.