Mileage Reimbursement 2024 Medical

21 cents per mile (decreased 1 cent from the 2023 irs mileage rate) charitable use: 67 cents per mile driven for business use.

In 2024, the irs medical mileage rate is 21 cents per mile, offering taxpayers a small break when they drive their vehicle to receive essential medical care. This notice provides the optional 2024 standard mileage rates for taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes.

Page Last Reviewed Or Updated:

21 cents per mile (decreased 1 cent from the 2023 irs mileage rate) charitable use:

1, 2024, The Standard Irs Mileage Rates For Cars (Also Vans, Pickups, Or Panel Trucks) Are As Follows:

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Images References :

Source: shelqelisabeth.pages.dev

Source: shelqelisabeth.pages.dev

Mileage Rate 2024 Reimbursement Emmey Iormina, 67 cents per mile for business purposes. The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons is 22 cents a mile.

Source: cariottawgipsy.pages.dev

Source: cariottawgipsy.pages.dev

Mileage Reimbursment 2024 Minna Sydelle, 14 cents per mile driven in service of charitable organizations. According to the irs, in 2024, the standard mileage rate for businesses is $0.67 per mile, $0.21 per mile for medical, and $0.14 per mile for charities.

Source: dierdrewclari.pages.dev

Source: dierdrewclari.pages.dev

What Is The 2024 Mileage Reimbursement Rate Janey Lisbeth, For 2024, the irs standard mileage rates are: 2024 irs mileage reimbursement rates.

Source: lulaqmirabel.pages.dev

Source: lulaqmirabel.pages.dev

Mileage Rate Reimbursement 2024 Vera Allison, 21 cents per mile (decreased 1 cent from the 2023 irs mileage rate) charitable use: Do you drive for business, charity or medical appointments?

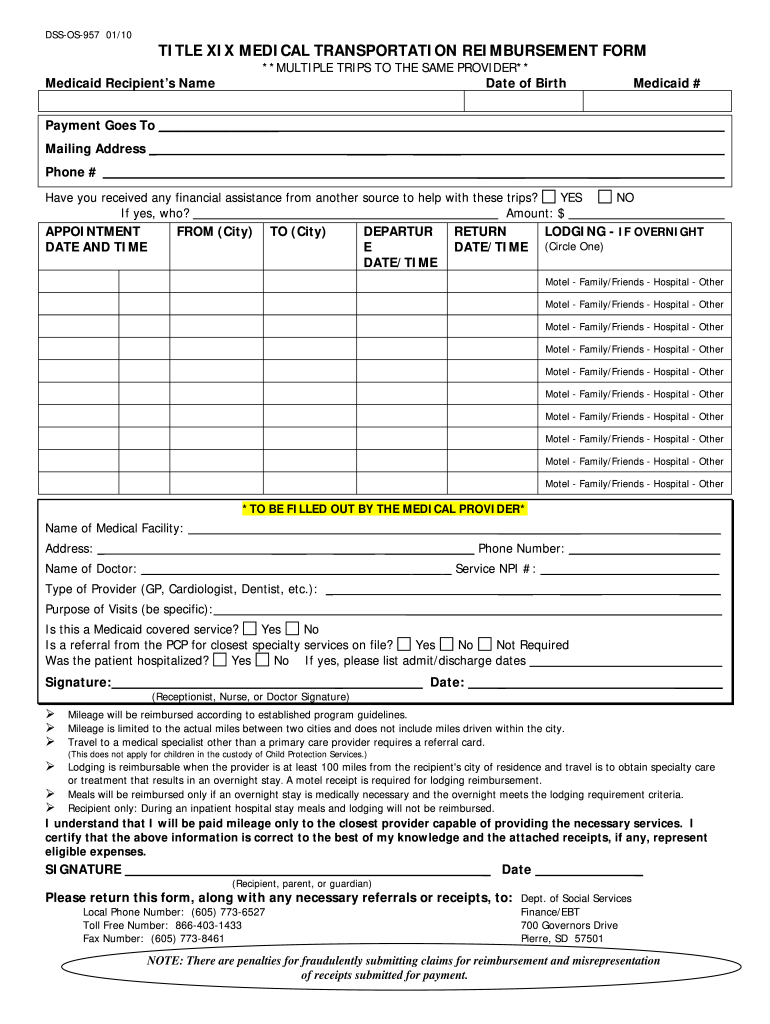

Source: www.dochub.com

Source: www.dochub.com

Medicaid mileage reimbursement form Fill out & sign online DocHub, At the end of last year, the internal revenue service published the new mileage rates for 2024. The 2024 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year.

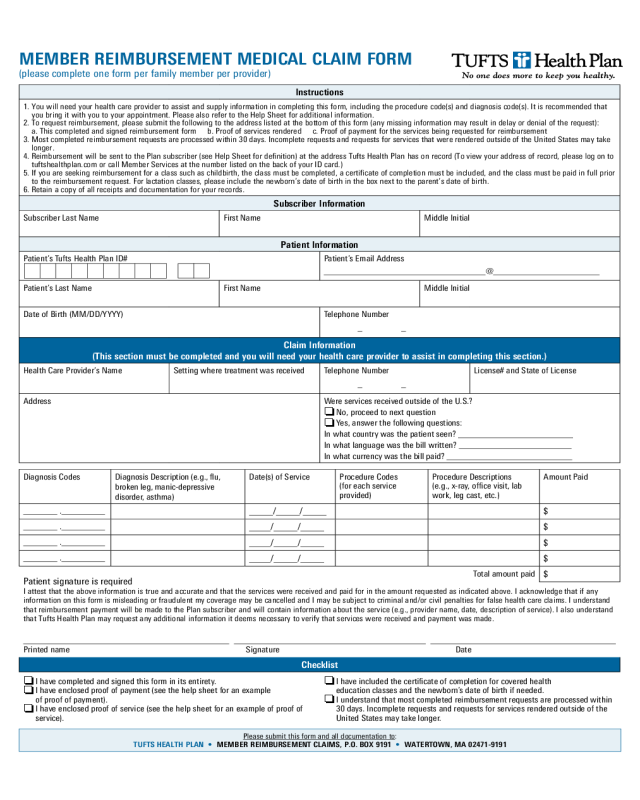

Source: handypdf.com

Source: handypdf.com

2024 Medical Reimbursement Form Fillable, Printable PDF & Forms, The standard business mileage rate increases by 1.5 cents to 67 cents per mile. In 2024, the irs medical mileage rate is 21 cents per mile, offering taxpayers a small break when they drive their vehicle to receive essential medical care.

Source: dorisqpatrice.pages.dev

Source: dorisqpatrice.pages.dev

Mileage Reimbursement 2024 Oregon Cora Meriel, What is the federal mileage reimbursement rate for 2024? The irs sets a standard mileage rate each year to simplify mileage reimbursement.

Source: marielewandrei.pages.dev

Source: marielewandrei.pages.dev

Irs Mileage Rate 2024 2024 Nan Lauren, The standard business mileage rate increases by 1.5 cents to 67 cents per mile. You may be eligible for a considerable tax deduction if you frequently travel for medical reasons.

Source: devoraqkaitlin.pages.dev

Source: devoraqkaitlin.pages.dev

Government Mileage Reimbursement 2024 Tomi Agnesse, 21 cents per mile for medical or moving purposes. 14 cents per mile driven in service of charitable organizations.

Source: www.pinterest.com

Source: www.pinterest.com

This mileage reimbursement form can be used to calculate your mileage, 14 cents per mile for service to a charitable. What is the federal mileage reimbursement rate for 2024?

67 Cents Per Mile For Business Purposes.

The internal revenue service has a set of guidelines to determine what is considered medical travel.

This Rate Reflects The Average Car Operating Cost, Including Gas, Maintenance, And Depreciation.

New standard mileage rates are:

Category: 2024